Hometown Tax for International Residents in Japan

If you have a salary in Japan and pay income and residence taxes to the Japanese government, then you, too, can enjoy the benefits of the Furusato Nozei (Hometown Tax) Program!

1.What is Furusato Nozei or the “Hometown Tax”?

Brief Overview of the Hometown Tax System

All residents in Japan are required to pay a Residence Tax to the city or town they are living in as of January 1st. However, since most of Japan’s population is concentrated in urban areas, there is a huge tax revenue disparity between urban and rural municipalities. The Hometown Tax Program is a way to balance out that disparity in tax revenue. This is called a “tax” program, but think of it more like a donation.

Through the Hometown Tax Program, you can choose the amount of money you want to donate. From the amount you donated, you’ll receive a tax deduction from your Residence Taxes the following year, minus \2000. Plus, you’ll also receive a thank-you gift from the municipality you donated to! Gifts can include local specialties, handicrafts, and more!

Also, the “hometown” you choose doesn’t have to be a place where you’ve had a prior connection. Through the Hometown Tax Program, you can choose any municipality you want to support. So, even if you haven’t lived here, you could still support a city like Kyotango!

Pros to the Hometown Tax Program

On top of getting a tax deduction, you’ll also receive a thank-you gift from the municipality you donated to when you donate through the Hometown Tax Program (you will not get a thank-you gift if you donate to your own municipality)!

Plus, another great part of the Hometown Tax Program is that you can choose where your money goes and how it can be used!

① Get a Tax Deduction!

After making your donation, you can receive a tax deduction totaling to the amount you donated minus \2000 on your Residence Taxes for the following year when you file.

② See your Donation Help the Cause of your Choice!

our donation will be used effectively in the area or cause of your choice! For instance, you can choose a variety of initiatives to donate to, such as cleaning up plastic waste in the ocean, traffic safety for kids, care support for the elderly, preservation of traditional cultural activities/crafts/festivals, disaster recovery efforts, and more!

③ Get a Local Gift as Thanks!

Packed with love and care by local producers, your thank-you gifts will be delivered from your chosen area directly to your doorstep! Many of the goods you can choose from are hand-selected to be of the highest quality, so you may be able to receive items that you wouldn’t find in your own city. Your thank-you gift is also a fantastic way to discover the country without leaving your house.

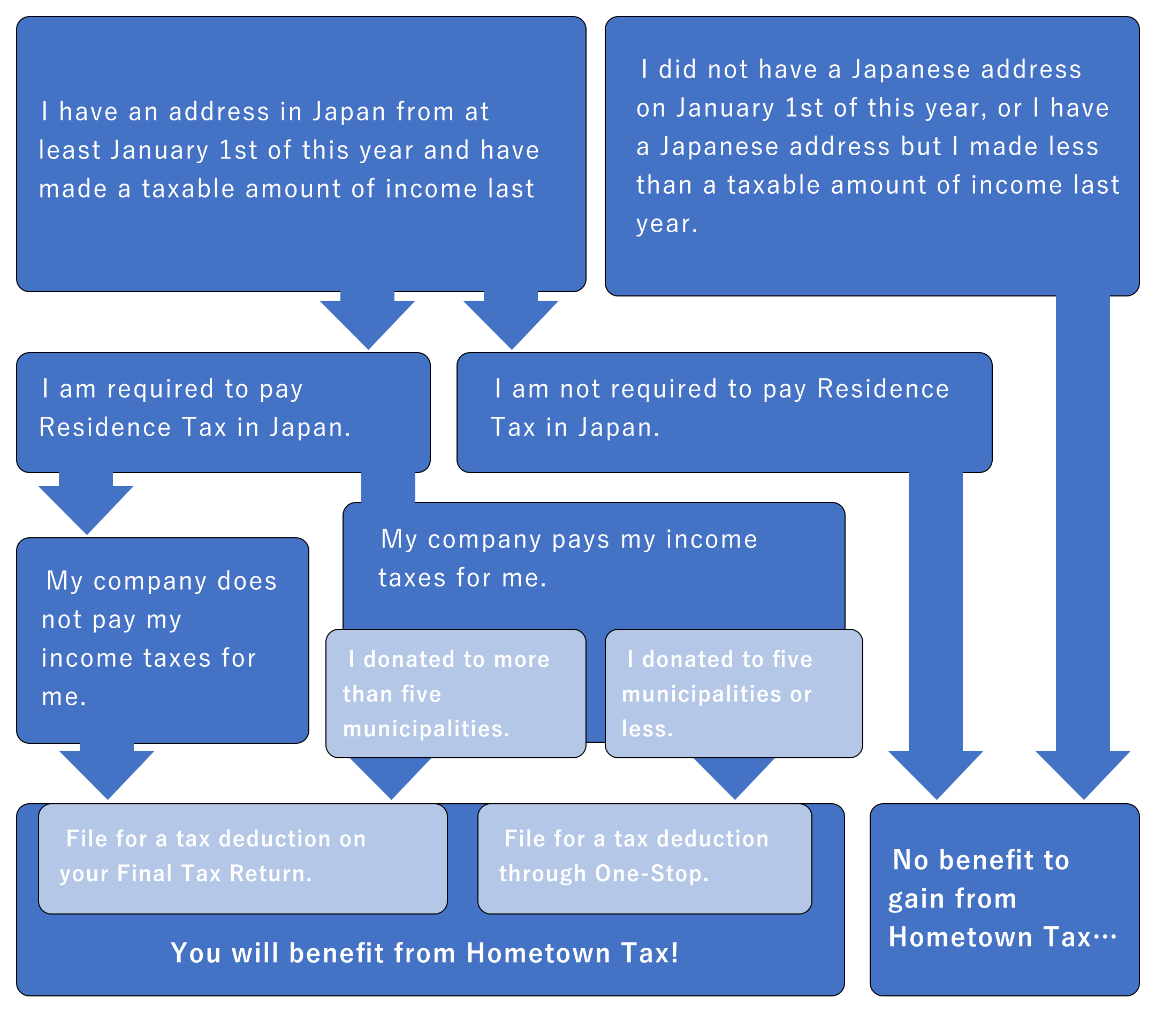

“Will I Benefit from Paying Hometown Tax?”

※Companies will usually deduct your income taxes from your salary every month. However, cases may differ, so please inquire about the details with your employer directly.

1.What is Furusato Nozei or the “Hometown Tax”?

There are only FOUR steps to send your Hometown Tax to Kyotango!

Step 1

Look it up!

Step 2

Browse & Donate

Step 3

Receive your Gift

Step 4

File your Taxes

Step 1 Look up your Maximum Donation

- - Maximum Donation will differ from person to person

More information here → 3. How Much can you Donate? (see page section)

Step 2 Donate to the Municipality of your Choice

(Browse for a Thank-you Gift and Finish your Payment)

- - In addition to Kyotango City’s Hometown Tax Website, there are many other websites that can process your donations. Browse and choose your thank-you gift from over a thousand different options.

For more information → Hometown Tax Websites (jump to section) - - If you pay by credit or debit card, your donation will be processed automatically. For more information → 4. Let’s Make A Donation (jump to section)

Step 3 Receive your Thank-you Gift and Donation Receipt

- - Depending on the thank-you gift, the time it will take to ship the goods to your doorstep will differ, i.e. seasonal produce or made-to-order.

- - If you are filing your donations on you Final Tax Return, your donation receipts will be necessary. Please file them away in a safe place at home. More information here → Processing your Donation (jump to section)

Step 4 File for Tax Deductions (via Final Income Tax Return or One-Stop Special Exception System)

- - This is a very important step! If you do not report your donation on your tax return, you will not get a deduction on your taxes the following year.

- - The One-Stop Special Exception System is a convenient way to report your donation without having to report it on your tax return. As long as you submit the application form sent to you by the municipality you donated to, then you can receive your tax deduction the following year. However, you have to fulfill a certain set of conditions in order to use One-Stop. For more information → 4. Let’s Make a Donation (jump to section)

1.What is Furusato Nozei or the “Hometown Tax”?

Let’s Estimate your Maximum Donation

In the Hometown Tax Program, a larger donation doesn’t necessarily mean more tax deductions.

Your maximum donation is determined from your family structure, annual income, and tax deductions that you already receive.

In the event you donate more than your maximum donation, your total out-of-pocket expense will end up being over \2,000. So, it’s important not to exceed your maximum donation to receive maximum benefits!

Now, let’s take a look at how much you can donate in a year and keep your total out-of-pocket expense at \2000.

Before you begin…

Your maximum donation is calculated from last year’s income. Please use last year’s income as reference when looking for how much you can donate.

Estimate for Maximum Donation

★…2nd Year Participant on the JET Programme

| Annual income of the person who is eligible for hometown tax | Family structure | |||||

|---|---|---|---|---|---|---|

| Single or dual-income※1 | Married couple※2 | Dual-income+1 child(high school student※3) | Dual-income+1child (university student) | Dual-income+2children (university student and high school student) | Married couple+2 children (university student and high school student) | |

| 3 million yen | 28,000 | 19,000 | 15,000 | 11,000 | 7,000 | |

| 3.25 million yen

★←

|

31,000 | 23,000 | 18,000 | 14,000 | 10,000 | 3,000 |

| 3.5 million yen | 34,000 | 26,000 | 22,000 | 18,000 | 13,00 | 5,000 |

| 3.75 million yen | 38,000 | 29,000 | 25,000 | 21,000 | 17,000 | 8,000 |

| 4 million yen | 42,000 | 33,000 | 29,000 | 25,000 | 21,000 | 12,000 |

| 4.25 million yen | 45,000 | 37,000 | 33,000 | 29,000 | 24,000 | 16,000 |

| 4.5 million yen | 52,000 | 41,000 | 37,000 | 33,000 | 28,000 | 20,000 |

| 4.75 million yen | 56,000 | 45,000 | 40,000 | 36,000 | 32,000 | 24,000 |

| 5 million yen | 61,000 | 49,000 | 44,000 | 40,000 | 36,000 | 28,000 |

| 5.25 million yen | 65,000 | 56,000 | 49,000 | 44,000 | 40,000 | 31,000 |

| 5.5 million yen | 69,000 | 60,000 | 57,000 | 48,000 | 44,000 | 35,000 |

| 5.75 million yen | 73,000 | 64,000 | 61,000 | 56,000 | 48,000 | 39,000 |

| 6 million yen | 77,000 | 69,000 | 66,000 | 60,000 | 57,000 | 43,000 |

| 6.25 million yen | 81,000 | 73,000 | 70,000 | 64,000 | 61,000 | 48,000 |

| 6.5 million yen | 97,000 | 77,000 | 74,000 | 68,000 | 65,000 | 53,000 |

| 6.75 million yen | 102,000 | 81,000 | 78,000 | 73,000 | 70,000 | 62,000 |

| 7 million yen | 108,000 | 86,000 | 83,000 | 78,000 | 75,000 | 66,000 |

| 7.25 million yen | 113,000 | 104,000 | 88,000 | 82,000 | 79,000 | 71,000 |

| 7.5 million yen | 118,000 | 109,000 | 106,000 | 87,000 | 84,000 | 76,000 |

| 7.75 million yen | 124,000 | 114,000 | 111,000 | 105,000 | 89,000 | 80,000 |

| 8 million yen | 129,000 | 120,000 | 116,000 | 110,000 | 107,000 | 85,000 |

| 8.25 million yen | 135,000 | 125,000 | 122,000 | 116,000 | 112,000 | 90,000 |

| 8.5 million yen | 140,000 | 131,000 | 127,000 | 121,000 | 118,000 | 108,000 |

| 8.5 million yen | 145,000 | 136,000 | 132,000 | 126,000 | 123,000 | 113,000 |

| 9 million yen | 151,000 | 141,000 | 138,000 | 132,000 | 128,000 | 119,000 |

| 9.25 million yen | 157,000 | 148,000 | 144,000 | 138,000 | 135,000 | 125,000 |

| 9.5 million yen | 163,000 | 154,000 | 150,000 | 144,000 | 141,000 | 131,000 |

| 9.75 million yen | 170,000 | 160,000 | 157,000 | 151,000 | 147,000 | 138,000 |

| 10 million yen | 176,000 | 166,000 | 163,000 | 157,000 | 153,000 | 144,000 |

| 11 million yen | 213,000 | 194,000 | 191,000 | 185,000 | 181,000 | 172,000 |

| 12 million yen | 242,000 | 239,000 | 229,000 | 229,000 | 219,000 | 206,000 |

| 13 million yen | 271,000 | 271,000 | 258,000 | 261,000 | 248,000 | 248,000 |

| 14 million yen | 355,000 | 355,000 | 339,000 | 343,000 | 277,000 | 277,000 |

| 15 million yen | 389,000 | 389,000 | 373,000 | 377,000 | 361,000 | 361,000 |

| 16 million yen | 424,000 | 424,000 | 408,000 | 412,000 | 396,000 | 396,000 |

| 17 million yen | 458,000 | 458,000 | 442,000 | 446,000 | 430,000 | 430,000 |

| 18 million yen | 493,000 | 493,000 | 477,000 | 481,000 | 465,000 | 465,000 |

| 19 million yen | 528,000 | 528,000 | 512,000 | 516,000 | 500,000 | 500,000 |

| 20 million yen | 564,000 | 564,000 | 548,000 | 552,000 | 536,000 | 536,000 |

| 21 million yen | 599,000 | 599,000 | 583,000 | 587,000 | 571,000 | 571,000 |

| 22 million yen | 635,000 | 635,000 | 619,000 | 623,000 | 607,000 | 607,000 |

| 23 million yen | 767,000 | 767,000 | 749,000 | 754,000 | 642,000 | 642,000 |

| 24 million yen | 808,000 | 808,000 | 790,000 | 795,000 | 776,000 | 776,000 |

| 25 million yen | 849,000 | 849,000 | 830,000 | 835,000 | 817,000 | 817,000 |

(Source:Ministry of Internal Affairs and Communications Furusato Nozei Portal)

※1 “Dual Income” indicates cases when the person paying the Hometown Tax does not receive a tax deduction for their spouse (i.e. when the spouse earns more than 2.01 million yen annually)

※2 “Married couples” indicates cases when the person contributing to Hometown Tax has a spouse who does not have a taxable income.

※3「High-school students are dependents from 16 to 18 years old, and University students are specific dependents from 19 to 22 years old.

※4 Since children under middle school age have no effect on your tax deductions, they are not listed in the calculations above.

◆To calculate your maximum donation in more detail, go to : https://www.furusato-tax.jp/about/simulation?top_left_pr (Furusato Choice)

4. Let’s Make A Donation

Recommended Thank-you Gifts from Kyotango City!

Browse our selection of recommended products for your thank-you gift! All of the descriptions are written in English, so you can browse with ease!

Browse Thank-you Gifts here (jump to the English catalog)

Now that you know your maximum donation amount, why not try donating? As long as the donation is within your maximum, your out-of-pocket expense will always be \2000.

How to Donate

Donate in Five EASY steps!

Add to Cart

Enter your Basic Information

Enter your Shipping Address

Double Check your Information

Finish Making your Donation!

For more detailed information on donations, click here (jump to external page)

How to File your Donation

◇You won’t get your deduction by just donating!

You’re not done with the Hometown Tax process when you make your donation. In order for the deduction to apply to your taxes in the following year, you must file your Final Income Tax Return and apply for the tax deduction by the corresponding deadline.

◇In the past, the only way to receive deductions for Hometown Tax was through filing your tax returns. If you fulfill certain prerequisites, then you can receive your tax deductions through the easy-to-use One-Stop Special Exception System instead of filing your donations on your Final Income Tax Return.

When you make your donation, you can check a box to ask for the One-Stop Application Form. Afterwards, the municipality you donated to will send you the Application Form. Fill out the required information, and just send it back to the municipality by January 10th the following year!

Final Income Tax Return

If you are self-employed, handle your own tax returns, or donate to six or more municipalities through the Hometown Tax Program in a single year, you will need to report your donations through your Final Income Tax Return. You have until March 15th the following year to turn in the Proof of Donation Certificate and report your donations to your local public tax office.

For more about reporting through your Final Income Tax Return, go to:

https://www.nta.go.jp/taxes/shiraberu/shinkoku/tebiki/2021/foreigner/index.htm (National Tax Agency website)

Hometown Tax One-Stop System

If you are a salaried employee and donate to less than five municipalities, you can apply for the One-Stop Special Exception System when you make your donation. Please submit the application for One-Stop and all the other required documents to the municipality you donated to by January 10th the following year. You will also need to submit a copy of your personal identification documents such as a MyNumber Card or a Photo ID with a document that has your MyNumber to the municipality.

Click here to view a sample of the One-Stop Application (PDF)

◇Know your Submission Deadlines!

Final Income Tax Return: Submit your forms and documents in-person or by mail to your local public tax office, or submit through e-Tax by March 15th the following year.

Hometown Tax One-Stop System: Submit the necessary documents to the municipality you donated to by January 10th the following year by mail. (You will need to fill out separate forms for each donation, even if it is to the same municipality)

◇When You Donate Affects When Your Tax Deductions Apply◇

Donations made from January 1st to December 31st are eligible for tax deductions the following year. If you would like your tax deductions to apply to your Residence Taxes in the following year, you will need to finalize your donation payments by December 31st.

You can also donate to Kyotango City’s Hometown Tax Program through the websites below (Japanese only):